Making sense and making more money from software pricing models

Software companies don’t always adopt the same pricing models, even when they are selling a similar service to competitors in the same market or sector. There is a psychology behind why different pricing models are adopted, which is what we will explore in this article.

A formal pricing structure is needed

In the early days of any software company, knowing how much to charge is one of the biggest challenges. Many products emerge from problem-solving exercises. From side-projects, even hobbies; therefore, for a developer, pricing can seem like an academic question. Enough to cover costs, but not so much that it seems greedy.

Once a company evolves, either as a result of clients eager to hand over their money, or an investor getting onboard, a formal pricing structure is needed. Deciding this can take time, which is often something that happens before sales staff are hired. Pricing needs to result in revenue that covers costs as a company grows and generate profit.

Cashflow is everything, so pricing models also need to reflect that sustainable monthly revenue is preferable to unpredictable income. Now, how this model is applied is where it gets tricky. Here are some of the most popular options for software companies.

Before establishing a subscription-based pricing model it’s worth to determine prices that will allow your business to grow. Keeping it simple at this stage is crucial to building an easy to understand business model foundation.

Cost-Plus

This formula accounts all material, labor and overhead costs, then adds it to a markup percentage to create a profit margin. This model is based on one’s intuition and can be used to quickly grow within markets well understood by the seller. It is however vulnerable to competition that may steal your customers with lower margins - hence lower costs.

Competitor-Based

There is a certain dynamic to this model. Not only does it require in-depth understanding of who your competitors are, it also sets out to reverse-engineer their pricing models, value propositions behind those models, and then puts it all together, preferably with a lower price tag. But what if your competitors have it all wrong? You have probably seen your rivals experiment with costs of the exact same service, varying from $10 to $500+ monthly. This poses two problems.

There may be more money on the table than you think and a seemingly overpriced competitor can be dominating the market. The other problem is that clients will always compare you with a cheaper competitor. Selling software means you can’t really do 1:1 feature comparisons and thus buyers do tend to be anchored to a fixed base price established by the cheapest provider they can find.

Value-Based

Similar to competitor-based pricing, this model focuses on differentiation and segmentation. Providing unique software that solves a very particular problem, especially in a niche market, is a good condition to leverage this model. It allows for a high profit margin that sets the cost bar much higher than competitive offers.

This model takes market positioning very seriously. If you’re building a premium software brand for Enterprises you will want to avoid cognitive dissonance from charging low prices. Instead, focus on a value-based pricing model and charge what you think you’re worth.

Demand-Based

We’re getting used to this dynamic model thanks to Uber charging a premium for rides during rush hours. It boils down to elementary economics of the supply and demand relationship. Essentially the more your services are required, the higher the price tag. To maintain a solid revenue stream, when times are tough or simply there isn’t sufficient demand (eg. for seasonal businesses) prices can drop significantly.

Using this in software sales is possible thanks to performance analysis that helps determine the actual required resources that will be utilized to serve a customer. While this isn’t really efficiency-based pricing, it does make sense to combine both models mentally to ensure cash flow regardless of demand fluctuation.

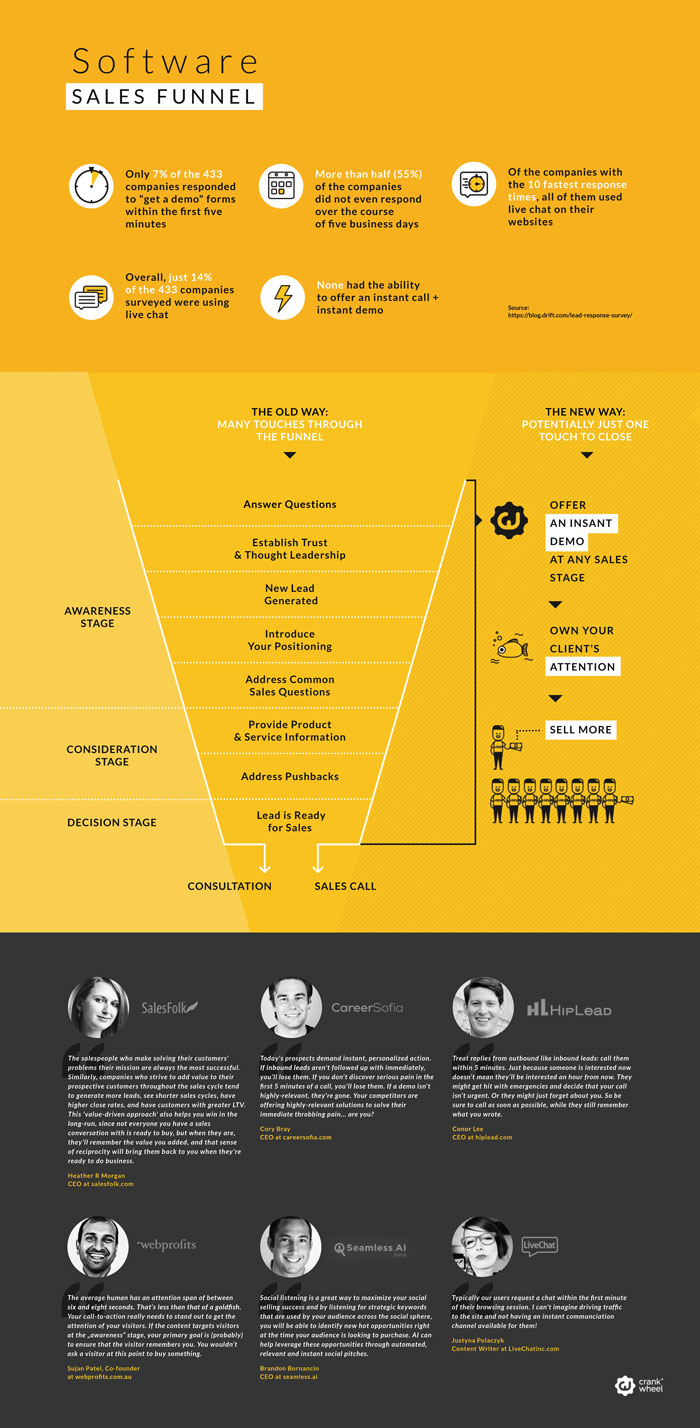

So how do you software companies generally sell?

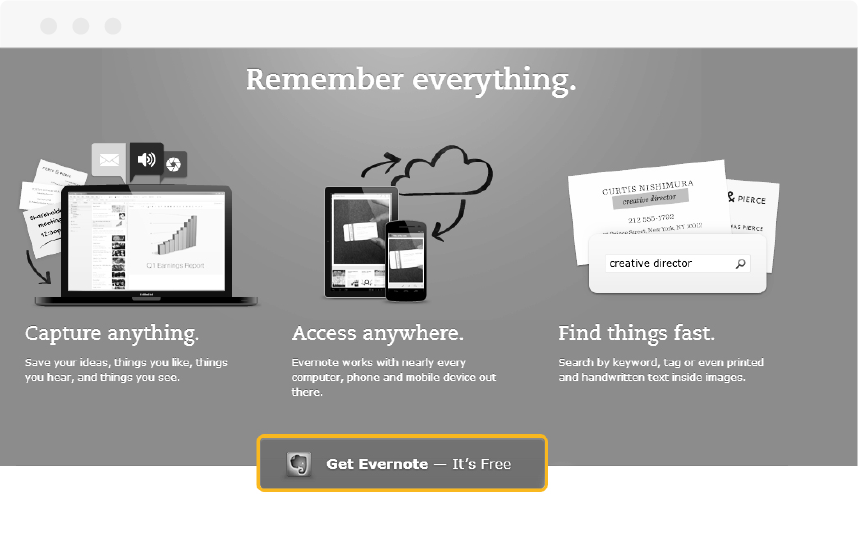

1: Freemium

This is a popular choice with apps, particularly consumer apps. Whenever you download something that says ‘Offers In-App Purchases’, it means the company behind the app is using the freemium model. Free to download and use, but with features that come with an added charge.

Whilst popular with B2C brands, most B2B companies only use the ‘free’ aspect of this model during the free trial period, when prospects can use all or most of the features without charge, to get them used to the software. Free Trial sign-up buttons are a prominent feature of many software and SaaS pricing pages.

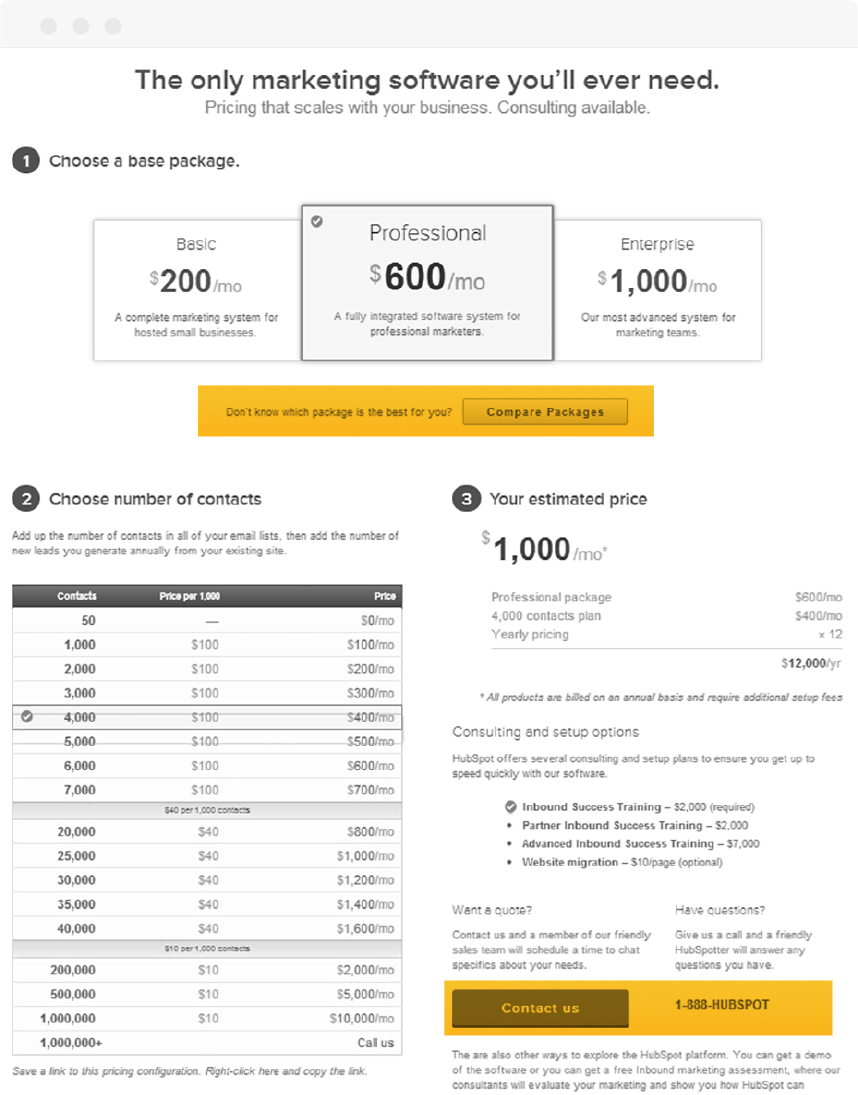

2: Subscription (tiered)

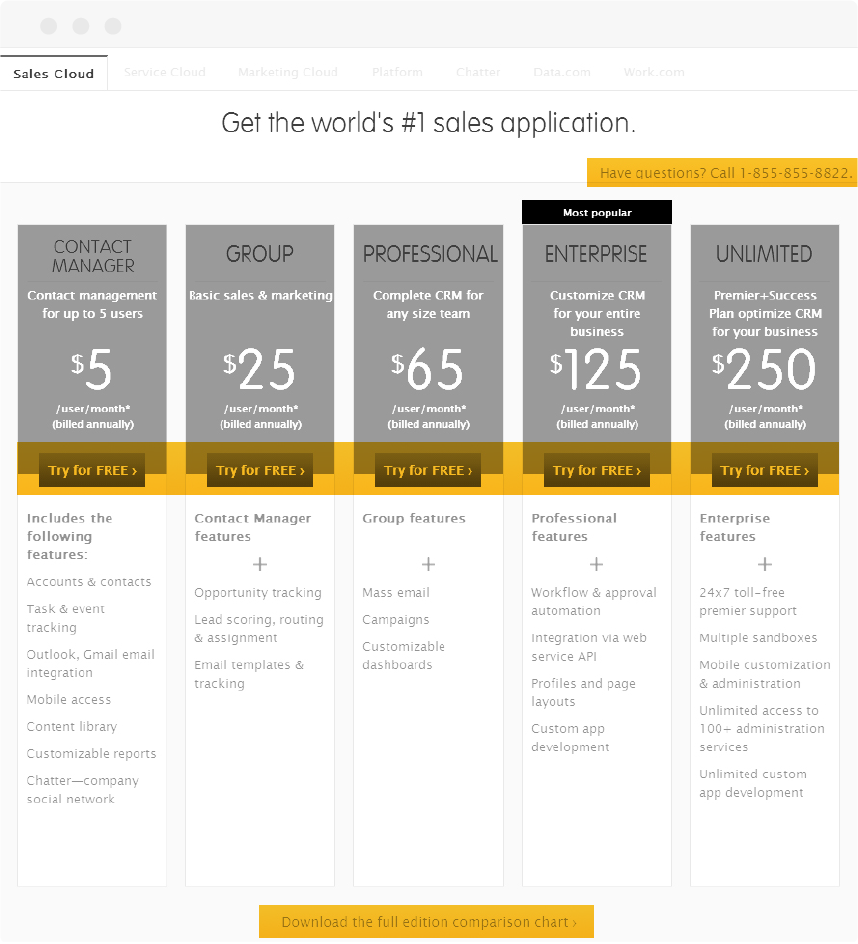

Tiered subscription pricing is one of the most effective models that software companies use. We have included multiple examples below.

Pricing can depend on a range of factors: number of user accounts, the number of times software completes a task (e.g. sending 2000 emails), the level of support provided, and the features customers can access at different price points.

Generally speaking, software companies aim to sell to startups and small businesses at lower price points, whilst reserving the highest prices for ‘Enterprise’ customers, where they need something customized or are providing a service to a large number of users.

Below are examples from some of the most widely used SaaS products on the market: Salesforce, Evernote, HubSpot and Basecamp.

3: Bespoke Pricing

Software companies, such as Salesforce, can also charge for additional services, such as customization, training or support. This means adopting a billable hour model for pricing, therefore multiplying the hourly rate of development or training staff by the number of hours a client needs that service.

When a client needs something bespoke, software companies can give a price for a one-off project, which is usually billed 50% at the start of the project and 50% on completion.

How software is priced depends on the needs of the business, the value of the service provided (ROI), client budgets - which includes what they would expect to pay - and competitor pricing models. Try and avoid over or undercharging. It is easier to spot when you are over-charging. Prospects will tell you they can’t afford the software.

Whereas, an extreme example of under-charging is trying to sell a large corporation on a $10 per month deal when they would willingly pay $1000. Position your pricing according to the perceived value a client can generate from the problem you are solving. If a client can save $1,000,000 annually from using your software, then $120 a year is far too cheap. Never forget, that markets set the price of everything. What customers actually pay is the most reliable litmus test of a pricing strategy.