How to Generate Facebook Ads for Life Insurance

The best-case scenario is to get in front of your clients so they can see that you are genuinely interested in helping them protect their loved ones with a life insurance policy. Without a doubt, Facebook ads can help you get to that juncture.

Digital marketing is the way to go, and most agents find that Facebook ads give them a lot of mileage for their marketing dollars. Regular ad campaigns will keep your sales funnel dripping with leads. Facebook ads for life insurance are effective at the top-of-the-funnel, middle-of-the-funnel, and bottom-of-the-funnel stages. They’re easy to set up, and they run automatically.

We’ll delve into why Facebook is such a great lead-generation platform and give you some awesome tips for getting a Facebook ad campaign started today.

Shortcuts:

How to Set Up Facebook Ads for Life Insurance

- Creating Personas by Personal Demographics

- Creating Personas by the Stage of the Sales Funnel

- Unique Ways to Expand Your Target Market

Creating Attention-Grabbing Ads

Life Insurance Facebook Ad Examples

How to Set Up Facebook Ads for Life Insurance

Facebook ads are effective for all types of life insurance prospecting – term, whole life, variable life, universal life, and annuities.

One of your ads may appear before a prospect at the exact time they are thinking about checking into it. A well-designed, well-placed ad can educate users about what they’ve always wanted to know about life insurance but didn’t take the time to ask.

Creating Personas by Personal Demographics

You know your products well and which candidates are the best for certain policies. Have you narrowly defined the best candidates for a life policy you want to promote?

Ask yourself the following questions:

- Are they male or female?

- How old are they?

- Are they married?

- Are they homeowners?

- Do they have children?

- Where do they live?

The answers to these questions will create a profile of your target customer for a certain life policy. Once you have a customer profile, you can then segment your audiences so you can customize your ads.

For example:

- Empty nesters and young people may be good candidates for a term policy but they’re at different stages of their lives.

- Young adults may be getting married or buying a home and you could create ads that motivate them to protect their homes and family members.

- Seniors and empty nesters may be more interested in understanding how life insurance impacts financial or estate planning.

You could essentially set up multiple audience segments to reach all personas at their current stage of life.

Creating Personas by the Stage of the Sales Funnel

After you get an initial influx of leads, you need to start identifying where those leads are in your sales funnel. Are your prospects just getting familiar with your brand, or are they ready to buy?

You can set up your sales funnel however it works best for you. The following six funnel stages suggest how to set yours up.

- Creating awareness (top-of-the-funnel)

- Generating interest (top-of-the-funnel)

- Evaluating their options (middle-of-the-funnel)

- Closing the sale (middle-of-the-funnel)

- Preparing for the renewal (bottom-of-the-funnel)

- Cross-selling (bottom-of-the-funnel)

To maximize the potential of your Facebook Ads, consider targeting ads to various parts of the sales funnel.

For example, in stage 1, the prospects aren’t aware they need life insurance. At this stage, focus your messaging on why they need to buy a policy.

In stage 2, your messaging could build on awareness to informing prospects about the risks of not having life insurance (leaving a mortgage or other debts to loved ones causing them to make a major change in their lifestyles).

In stage 3, you could build on your advertising even more by focusing on how the right life insurance solution can solve their problem.

Your customers should review their life insurance policies every year, so don’t discount stages 5 and 6. Have they reached a new milestone in life such as having children or getting nearer to retirement? A well-crafted Facebook ad could motivate someone to contact you to ask questions about how to protect their loved ones better at their current stage of life.

Unique Ways to Expand Your Target Market

There are more ways to expand your target market than categorizing them by personal demographics and the sales funnel.

Dig a little deeper into who your perfect customer for a particular life insurance product is. Ask yourself the following questions about the clientele you want to go after:

- What magazines do they read? (Parenting, AARP, health & fitness, etc.)

- Do they listen to podcasts on a particular topic? (Finance, politics, dieting, senior life, etc.)

- What shows do they watch? (Could be a generational indication)

- What are their hobbies? (Could gear ads towards golfers or around a major event like the Super Bowl)

- What are their professions? (White-collar, blue-collar, etc.)

- What professional tools or equipment do they use?

One of the great things about Facebook marketing is that you continually have opportunities to reimagine new audiences and expand your reach to get prospects interested in life insurance. Each time a prospect sees an ad, you’re strengthening your brand.

Creating Attention-Grabbing Ads

As a consumer yourself, you’ve seen some ads repeated over and over again. How many times have you found yourself rolling your eyes and reciting a commercial by memory when you see it?

Facebook ads allow you to change your messages as often as you want to and it won’t take very much time away from your selling schedule.

Just as importantly, Facebook ads give you a lot of variety in how you deliver messages so your target audience won’t be bored to tears.

The following list of ad types shows just how much variation you can create in your ads:

- Video ads

- Photo ads

- Story ads

- Carousel ads

- Slideshow ads

- Poll ads

- Lead ads (allow prospects to give you contact information)

If a certain type of ad is generating stellar results, keep using it but be sure to spice up your marketing strategy by changing things up to keep prospects engaged.

Building Effectiveness into Facebook Life Insurance Ads

Meta acknowledges that relevance is key to a good experience for consumers and advertisers. According to Hubspot, relevance matters, and so does visual appeal, value, and a solid call-to-action.

Here’s a breakdown of why you should consider these four elements when creating Facebook life insurance ads.

Visual Appeal

Will your ad create a buzz on social media? Is it something people are likely to share? Are people commenting on it?

If you’re not sure, get some feedback from people, especially if they’re in the market for life insurance. Another way to test your ads is to send a couple of examples to your existing clients and ask them to give them a thumbs up or thumbs down.

Facebook life insurance ads that spark emotion are often effective which is why storytelling through a video can have a large impact. For static ads, think about the colors and visual appeal in the design.

Valuable

Target marketing and creating personas will help you craft an ad that speaks the value that a particular demographic of people. New homeowners will be looking to protect their investments. Seniors may be looking for whole life, guaranteed issue, or final expense insurance. Prospects may find value in an ad that emphasizes the strength of branding of a particular carrier.

Relevance

Nearly everyone needs life insurance, but they need it for different reasons depending on the stage of life they’re in.

New homeowners will be looking to protect their investments. Seniors may be looking for whole life, guaranteed issue, or final expense insurance. Prospects may find value in an ad that emphasizes the strength of branding of a particular carrier.

Make sure the right audiences are seeing ads that are relevant to them.

Solid CTA

The CTA should be intuitive. Do you want them to contact you for more information or click to get an instant quote? Your CTA could send them to a landing page where they can learn more about the product you’re advertising.

Life Insurance Facebook Ad Examples

We’ve put together a couple of the best life insurance Facebook ads to help you see how visual appeal, value, relevance, and a solid CTA join forces to increase lead generation.

Midland National Life Insurance

Visual appeal – Blue in advertising means trust, loyalty, authority, and calmness. The image is one of a grandmother caring for her granddaughter’s future, and that warrants checking into life insurance.

Value – This is a video ad that asks at the beginning and end, “Do I need life insurance?” The video also talks about living benefits as well as death benefits. The content is well-written and answers the question well.

Relevance – This ad will show up for the target audience you select and it will also appear for anyone who has looked for life insurance online.

Solid CTA – This ad ends with a CTA that says, “Contact your financial professional today.” This is a nice touch as people often want to buy life insurance from someone they trust.

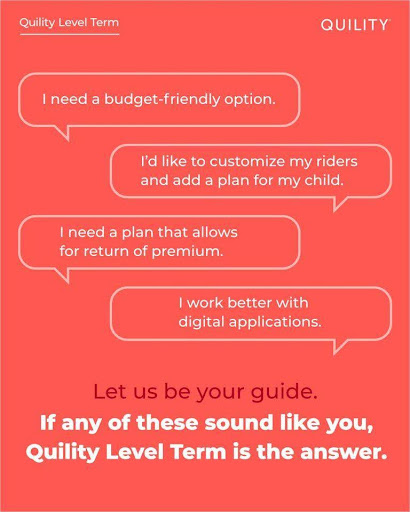

Quility

Visual appeal – The red color evokes energy and passion in an ad. The ad bubbles make you think of a conversation you might have with yourself but need to have with an insurance professional.

Value – The questions lead you to believe you can have all those features in one product. And you can.

Relevance – The dialogue in this ad lets you know that a simple level term can also have a few important bells and whistles.

Solid CTA – Simply put, “Let us be your guide.” This ad’s CTA leads prospects directly to an agent.

These life insurance Facebook ad examples show how to make your ads stand out and get prospects thinking about how they can take the next steps in buying life insurance.

9 Steps to Publishing Facebook Ads for Life Insurance

Most people find that setting up Facebook ads is fairly intuitive. Follow these steps and your ad will be visible in no time:

- Set up a Facebook business account page if you haven’t already done so. You won’t be able to run ads through your personal account.

- Verify your business and set up your payment method.

- Install the Meta pixel which is a snippet of code you put in the backend of your website which will track your visitors and their behavior.

- Determine the target audience and persona you want to target (location, age, gender, languages spoken, interests, behaviors, etc.)

- Create a campaign and give it a name.

- Create a set of ads for the campaign.

- Link to your privacy policy. (if you have a WordPress site, you can add a plugin to generate a privacy policy)

- Customize a thank you screen if you’ve asked them to input contact information.

- Set a budget for your campaign.

- Select “add media” to upload a new ad or create a video.

- The ad fields ask you to create primary text, a headline, a description, and a CTA.

- Publish your ad.

It generally doesn’t take long to start getting results on pay-per-click ads, so don’t be surprised if you start getting impressions on your ads in short order.

Meta is eager to help you be successful with Facebook Ads. Find more detailed information at the Meta Business Help Center.

Monitoring Your Performance

Finally, be sure to check out your analytics page fairly often to see how your ads are performing.

Look for trends, deviations, and underperforming ads.

Also, pay special attention to the cost per result which equates to your cost per lead. This data will tell you how much you need to invest in the bottom of the funnel in the days and weeks ahead.

Other metrics to monitor are:

- Click-through-rate (CTR)

- Engagement rates

- Conversion rates

- Return on ad spend (ROAS)

Not getting the results you were hoping for? Don’t give up. Consider making some adjustments to your ad text or images and test different ads against each other. You could also refine your target audience, remarket an ad, or create a look-alike ad. There’s always something you can do to get those life insurance leads streaming in.

Facebook’s popularity is indisputable which is why it’s such a great vehicle for advertising to life insurance prospects and increasing brand awareness. By defining your target audience and creating distinct personas, you make it easy for prospects to find you. Facebook ads for life insurance make it easy for prospects to contact you using a variety of communication channels – phone, chat, text, email, Facebook Messenger, and contact forms.

Well-crafted ads displayed at times when Facebook users are active will generate interest and inspire trust in your target audience.

The dynamic nature of the ad manager system allows you to optimize Facebook ads for life insurance based on real-time data to ensure you keep your conversion rates high and your budget on track.