PPC Marketing for Insurance Agents

Clients look for the best deal among various insurance before they conclude to make the correct decision and choose the right insurance policy. However, when you make an insurance sale, you stand for your recognition in the competitive marketing world.

Insurance agents must work more often to increase their client list as the business companies have a rigid rivalry to acquire more prospects. This competition requires a vivid description of strategies to be a known enterprise.

The virtual availability of any enterprise undoubtedly is a better choice to put yourself on the list of your potential client’s final decisions. The key to achieving this goal can be through pay-per-click advertising (PPC).

This article will guide you through PPC marketing, its importance, credibility toward insurance agencies, and how to grow your insurance business through PPC marketing. There is more relevant information regarding PPC marketing that you must acknowledge.

Shortcuts:

- What is PPC Marketing?

- Benefits of PPC for insurance Agents

- Why PPC Works for Insurance Agencies?

- What to Consider When Creating PPC Ads for Insurance?

- Do PPC Ads Help Insurance Agencies?

- PPC for Insurance Agencies: How to Get Started

- How Does PPC Advertising Makes Insurance Agencies Stand Out?

What is PPC Marketing?

Source:- WordStream

PPC, or pay-per-click, is a kind of digital marketing where advertising agencies pay a fee each time their ads are clicked. This fee transaction means the advertising company wants targeted audiences to their website or homepage.

Moreover, you only have to pay a fee for the advertisement if the visitor clicks through your website. It is an organic method that directs “purchased” visitors to your website, and your ad can be a medium to generate revenue and target your prospects.

Search engine advertising is a recognized medium for PPC marketing where the advertiser pays for each ad submission in the search engine’s funded links. It plays its role when a visitor searches for something using relative keywords that refer to your business services.

However, comparing pay-per-click advertisements and achieving website visits comes down to generating revenue. Still, if you look at a spontaneous approach toward achieving more prospects, PPC advertising is the correct option.

You can generate this organic traffic to your website using rich content display through social media platforms, search engines, and other digital marketing strategies, which is time-consuming to attain prospects.

So PPC marketing boosts the process in the situation, allowing more prospects to your site and engaging more audiences towards your agency. However, PPC marketing is just a head-start for your digital insurance marketing strategies, requiring all the other steps to play their significant roles.

Benefits of PPC for insurance Agents

Source:- Creative Click Media

Pay-per-click advertising has a 50% extra conversion rate by directing specific traffic to your website that pays the advertising agency for each visit than the organic traffic. Surveys also say that each dollar spent on Google AdWords provides an income of $2 as revenue.

See our article on organic lead generation strategies for insurance agents.

The data helps you understand the money spent on each advertising displayed for your enterprise and compare the revenue for insurance marketing. These ads allow you to approach new prospects when they click on the ad link and succeed in achieving a new client.

Here is a list of PPC achievements you can access and uplift your insurance business to be known among the people.

- Customized PPC is affordable and allows your ad to be displayed on the top search engine results page when searched using a related keyword of your business.

- It will enable you to be recognized by attaining more service prospects and generating targeted organic traffic.

- You can have various campaigns outlined and released for a single keyword from your business offerings.

- PPC offers increased click-through rates (CTR), conversion rates, and revenue generation through sales.

- Consistent traffic generation to your website.

Why PPC Works for Insurance Agencies?

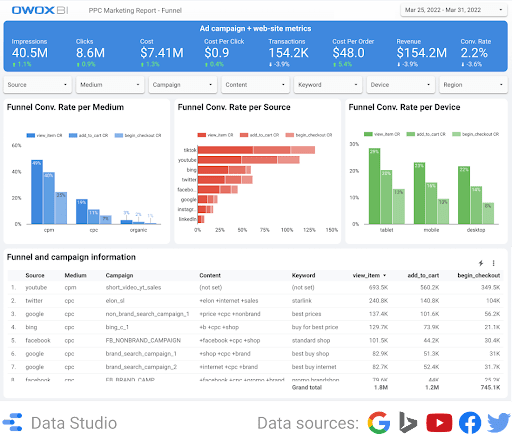

Source:- OWOX

When potential prospects search for information related to insurance on search engines like Google, they expect to have a deep insight into the various forms of insurance, their cost, credibility, and a highly trusted insurance agency among all the service providers.

Let’s understand the importance of pay-per-click for insurance agencies with the help of a simple example to assist you through the guide more efficiently. As per other marketing strategies are concerned, search engine optimization is also an efficient method.

Search engine optimation, or SEO, has been an effective method for insurance business agencies to generate organic leads. However, the strategy has now become old, as it’s very easy for any enterprise to alter its website with some changes and increase SERPs rankings.

You must be on the first search engine results page and use relevant keywords to match your website’s offerings. This strategy is a slow and work-intensive process for insurance companies because the list grows more when you add other agencies to the competition.

You merely have ten spots on the Google search engine’s page, but thousands of competitive companies are fighting to be recognized as number one, making the complete scenario even worse. Here is a list of benefits offered by PPC in insurance marketing.

1. Access Authority

When a potential prospect searches for an insurance website for numerous reasons, they expect all the relevant information. If your website fails to meet their requirement and criteria, you might lose your possibility of achieving an organic lead.

However, when you pay for the click-throughs of your ads, you are the deciding factor responsible for allowing search results to showcase your site when there is relevancy from the keywords to connect your website.

2. Higher Lead Generation

When your business enterprise is available on the first page of search results, it allows your business to reach higher prospects. It increases visibility to a highly segmented group of potential insurance buyers.

This concept means that the chances of you being visible to any prospect increase when you understand what they are looking for and you have that particular offering for them. The more visible you are, the more potential prospects you have to draw through your sales funnel.

3. Instant Results

Paid ads allow you to be visible to those who want instant results with the right information, making it the best way to show your credibility to the targeted audiences. However, achieving your page response through organic SEO for insurance agents can take much work and time.

Moreover, pay-per-click allows you to be showcased on the first page of search results and gain complete control over who can see the things you have put on for sale and the services you provide via the insurance agency.

What to Consider When Creating PPC Ads for Insurance?

Source:- PPCexpo

You can implement various methods in your marketing agency for insurance that are of significant relevance to outgrow your insurance and claim to be better.

- You must ensure that your ads specify the company’s insurance sales to its clients, including life, home, vehicles, healthcare, tenants, etc. It initiates a strategy to include all your services and create an outline for your business goals.

- Ads can help showcase the offers you provide your customers on insurance services. You can increase your brand awareness among potential prospects so they know the deals you offer, the list of services, and a competitive outlook.

- Showcase your ads based on the location you want your ads to reach, meaning if you’re going to engage customers in a small city like Boston, then you must not display it somewhere in New York City. Design your PPC ads so that you receive preferences from targeted prospects of the same location.

- Change your ad preferences based on the statistical drops you regularly track to provide better insurance ads to your customers seeking a change in their preferences based on gender, age, etc.

- You can use relevant keywords to help your customer reach out easily for your services and allow your ads to represent the purchase amount for each insurance policy.

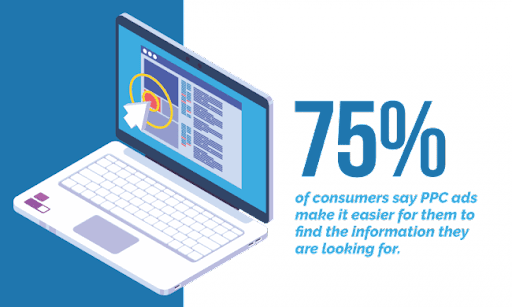

Do PPC Ads Help Insurance Agencies?

Surveys from Statista say that from all the available digital marketing platforms, PPC advertising acquires a higher rank of 20%, which provides the highest ROI performing better than other marketing platforms.

It is evident from the above data that search engine users tap the click-through PPC ads more frequently, which meets their necessities. You can create an ad that denotes the customer’s search results and touches the pain points of any visitor.

You must ensure that your PPC ad contains the best title, brief demonstration, and a personalized homepage or landing page to engage more prospects in your online services and convert them into organic clients.

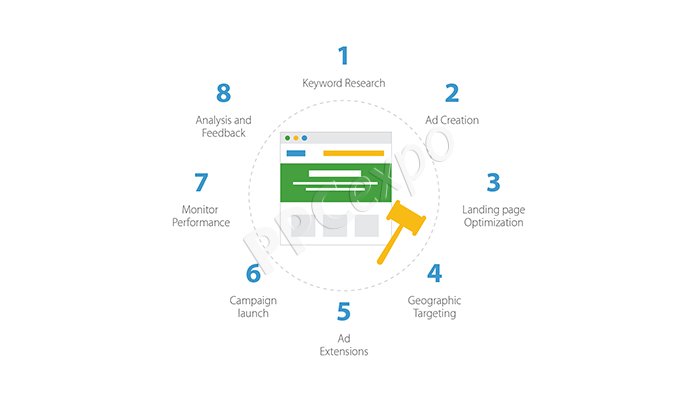

PPC for Insurance Agencies: How to Get Started

Source:- Talage

Marketing strategies have evolved for a long time as most marketers have started showcasing their business services online through digital media platforms. You must encourage physical labor in your businesses and use strategies online to uplift your marketing agency.

PPC advertising should be a tool initiated in every insurance agent’s marketing strategy to extract its benefits. Once you learn the correct implementation, you will know why PPC marketing is important for insurance agencies.

Here are a few methods that may need to get started with PPC in insurance:

1. Calculate Your Budget

You can customize your budget for better results from PPC advertising, as when you know how much to invest, you can better understand your spending. There are no limitations to the amount you can spend to achieve more prospects on your website is unlimited.

Google Ads allows insurance marketing agencies to set preferences on their budget limitations based on two factors that help you determine the amount you spend.

- The bid limit allows you to limit the amount spent on a particular keyword used in your website when searched and clicked.

- When you determine your average daily budget, it helps Google to know the amount you expect to spend each day, meaning that when you reach your specified limit of clicks through the ad, it won’t be displayed anymore on the search engine results.

Setting your spending limits for steady yet progressive growth is necessary, and changing your budget preferences accordingly when you achieve a greater ROI than expected.

2. Utilize Landing Pages

Landing pages or homepages are crucial for any PPC-based ad strategy development as it helps you understand the functioning of your ads. You can develop landing pages for each of your customized ad campaigns so that you can determine the traffic generated from them.

These designed campaigns help you generate more prospects and convert them into paying customers. For example, if you have an ad campaign related to life insurance, you must have a click-through link on your ad that takes the visitor to a page with all the related data.

Moreover, you can also include a CTA or call-to-action button to help your customers at any instance and answer the most frequently asked questions by the visitors. It will help you know the maximum traffic generated from the campaign and improvise when necessary.

Developing a landing page based on customers’ needs and requirements can help you generate better rates driving 65% conversion. Still, when customers realize that the keyword does not meet your content, they avoid your landing page and return to the SERP result.

3. Approach Insurance Customers in Particular Segments

Customers research various insurance policies before buying one, as they are very particular about their necessities and ensure that the desired policy fulfills all their requirements. If a person is looking for car insurance, what are the possible causes that they need it?

- Comparing prices between companies to understand the best price available for a vehicle insurance policy.

- Looking for an insurance policy that has more offerings than other deals.

- Insurance quotations for first-time buyers to help understand why they need a policy.

You must design your ads to display your customer’s concerns on various grounds, as mentioned above (for example), and help you achieve different potential prospects using the PPC ads. When you target your audiences, it enables you to yield high-end customer traffic.

Target-based customer strategies can include your customer that sees:

- Designing a pay-per-click ad that provides unique customer deals.

- Empowering your data with the help of statistics and saving customer expenditure.

Thus, having a well-customized customer approach mechanism will help your insurance policies to be recognized and increase sales.

4. Adjust Bidding Portfolio

It is a platform where you set your budget details and how to spend your budget money, while your target is to achieve more visitors and convert them into clients. However, there are many ways to acquire the specified goals.

When you initiate a customized budget, it helps you understand the in-between steps that are necessary for your PPC ad. Google allows its bidding strategy to be recognized based on your desired target keywords. There are three segments available:

- Broad match allows your ads to be open to the maximum number of prospects and has fewer limitations over the target keywords and phrasing.

- Phrase match reveals your ad to fewer prospects as it has strict limitations to keyword phrasing but increases the probability that the target people will see your ad.

- Exact match allows your ad to pop up when the prospect uses the same keyword phrase proving you have higher chances of ad exposure but also allowing you to lose clients.

Thus, you can adjust your bidding portfolio accordingly to gain better results by making click-though payments beforehand to the search engine and determining your limit or paying for the people that view your ad and not click on it.

How Does PPC Advertising Makes Insurance Agencies Stand Out?

Insurance is a significant marketing sector with more competition than expected, so you need to have marketing strategies like pay-per-click. These ads are a valuable source of customer generation when they search for policies online and click on the ad links.

PPC advertising allows for more brand awareness and assists potential customers with a roadmap to access your services. Instead of just having faith in search engine optimization, you can use PPC to help your business have prospects each time your ads are clicked.

Customize your ad to engage the visitor and compel them to purchase from your insurance policies. You can use AdWords tools to create an engaging ad description for your prospects and outline your offering in the best possible way.

Key Takeaways

Being a marketing insurance agent can be easy when you use the right marketing strategies to outline your preferences and meet your client’s needs. You must ensure a well-organized budget to calculate the money spent on these PPC ads individually.

PPC advertising is an excellent marketing strategy for insurance agencies to get their service known to potential leads and help your agency grow. We have provided you with all the information you need on PPC marketing in insurance agencies.

About the author

Joy D’Cruz is a content marketing specialist who is currently working with SaSHunt. Joy enjoys researching topics related to B2B and SaaS. On the weekends, he likes spending time watching YouTube.