Creating a Seamless Customer Journey for Medicare Advantage

Medicare beneficiaries looking for lower costs and bundled coverage are ideal customers for Medicare Advantage plans. As a broker or agent, you have the opportunity to create a seamless customer journey for individuals seeking a Medicare Advantage plan.

Seniors experience more health problems as they age. Dealing with health providers can be a bit unsettling as they move into this season of life. For that reason, they want a Medicare Advantage plan that covers their current health issues and any that emerge in the future.

A broker or agent who can break everything down, making it easily digestible, is a welcome partner. By mapping out the customer journey, you can identify and address this target audience’s pain points and plan your marketing strategy around them.

At the end of the journey, your new clients will be overjoyed that you guided them toward the best plan for their needs.

Shortcuts:

Understanding the Medicare Advantage Customer

- Defining Your Target Audience: Demographics of the Medicare Advantage Customer

- Solving Medicare Advantage Pain Points

Mapping the Medicare Advantage Customer Journey

- Awareness

- Research & Comparison

- Enrollment

- Onboarding and Utilization of Benefits

- Renewal or Switching Plans

Medicare Advantage Sales: 5 Key Elements of a Seamless Experience

- 1. Clear Communication

- 2. Omnichannel Engagement

- 3. Personalization

- 4. Customer Support Excellence

- 5. Easy Navigation

Enhancing the Customer Journey in Medicare Advantage Sales: Technology’s Role

- Customer Relationship Management System (CRM)

- Screen-Sharing Tool

- Quoting and Enrollment Software

- Compliance Automation Tools

Drive Medicare Advantage Sales by Creating a Seamless Customer Journey

Understanding the Medicare Advantage Customer

Medicare Advantage plans include Parts A and B, and can include Part D. Nonetheless, the combined coverage doesn’t suit everyone.

Medicare Advantage plans are popular because they can include extras that Original Medicare excludes. Medicare Advantage plans also often include additional services such as vision, dental, and hearing care, as well as other perks like gym memberships.

Defining Your Target Audience: Demographics of the Medicare Advantage Customer

Contrary to popular belief, seniors are becoming a tech-savvy group. Pew Research reports that the gap in the percentage of young people using smartphones versus seniors has narrowed over the last decade.

Seniors are increasingly finding technology useful, and they’re getting better at using it. While there is a lot of information about Medicare online, the program is complex for most people to understand. A seasoned healthcare professional

More than half of the Medicare population is enrolled in a Medicare Advantage plan, which amounts to 32.8 million enrollees, according to KFF.

The number of Medicare Advantage plans has grown due to legislative efforts, giving the average Medicare beneficiary access to 43 different plans. A valuable message you can promote is that you are a resource for information and plenty of choices.

Solving Medicare Advantage Pain Points

Do you understand the Medicare Advantage customer pain points?

Medicare typically feels foreign to new enrollees, because its structure is vastly different from their previous health plans.

At this late stage in life, they have to learn a whole new set of rules and enrollment dates. Many people find it emotionally taxing to learn about the multiple facets of Medicare.

By the time customers get to you, they’re confused and potentially misguided.

What they need from you is:

- To simplify the process

- To offer support

- To earn your trust

- To personalize their journey

It’s essential to remember these needs as you map out the customer journey to ease their angst and frustration.

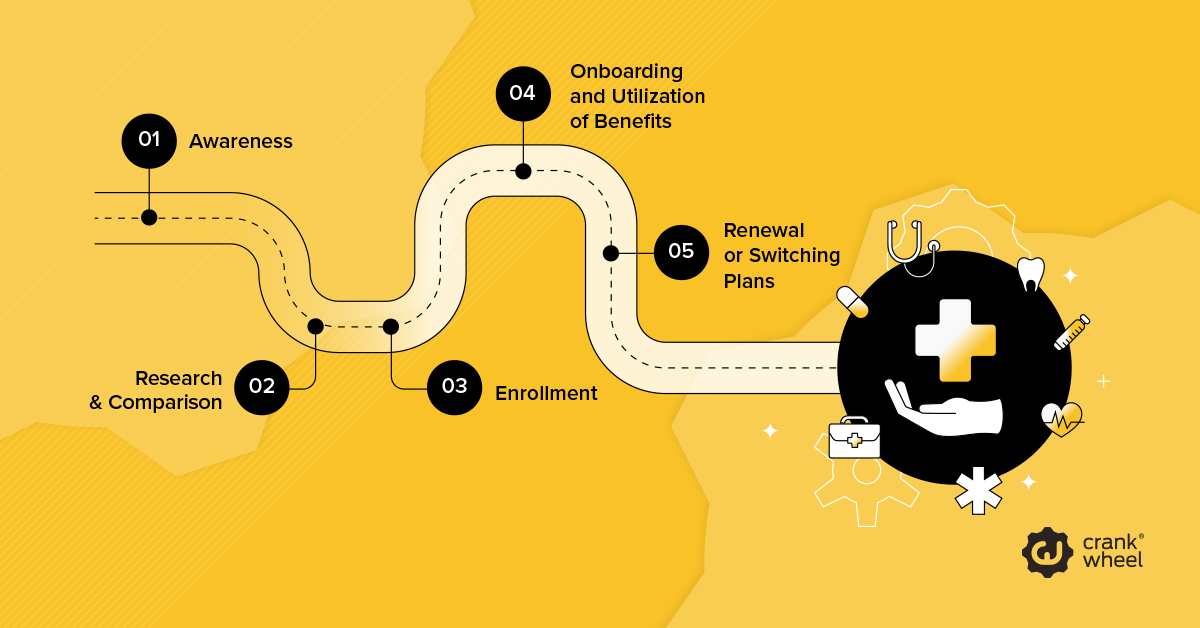

Mapping the Medicare Advantage Customer Journey

You know you’ve successfully created a seamless customer journey when you have made the path intuitive, effortless, and smooth.

It’s helpful to define the stages of the customer journey as you map out your marketing strategy.

At each of the following stages, consider your target customers’ needs and potential friction points:

Awareness

Needs

- Being sufficiently informed about the Medicare program

- Having assurance that they can get the necessary and desired coverage

Friction points

- Understanding Medicare has four separate parts, versus an inclusive health plan

- Fearing change will lead to hardship

Research & Comparison

Needs

- Learning how to shop for plans

- Understanding plan costs and out-of-pocket costs

Friction points

- Having concerns over gaps in coverage

- Having concern over costs

Enrollment

Needs

- Understanding enrollment periods

- Needing navigational help

Friction points

- Affirming when to enroll

- Lacking confidence in enrolling

Onboarding and Utilization of Benefits

Needs

- Having uncertainty about what to expect

- Needing professional guidance

Friction points

- Having limited support

- Dealing with a lack of follow-up

Renewal or Switching Plans

Needs

- Being unhappy with the current plan

- Failing to understand when or if they can switch plans

Friction points

- Fearing not finding a better plan

- Planning the right time to switch plans

As you can see, each stage of the sales process presents angst for the customer. By addressing their concerns in your marketing materials and presentation at the proper stages, you are on your way to gaining the customer’s trust.

A large part of perfecting the customer journey is using your expertise to put their fears and concerns to rest and helping them feel confident in their chosen plan.

Medicare Advantage Sales: 5 Key Elements of a Seamless Experience

To truly meet your clients’ needs, you need to deliver personalized information they can easily understand their options.

You can make that information easy to digest by ensuring your systems are intuitive and user-friendly. With technology at hand, your customers may also expect multi-channel accessibility.

Additionally, a little training in customer support and how to deliver an excellent customer journey will go a long way.

Let’s break down the five key elements of a seamless experience for Medicare Advantage customers.

1. Clear Communication

Having too many choices may confuse your customers. Cost and coverage comparisons, along with complex terminology, can quickly overwhelm your customers. Clear communication will calm your customers’ anxiety and enable them to enroll in their preferred Medicare Advantage plan.

Medicare Advantage enrollees don’t need to see every plan. They just need to see the plans that suit their needs and fit within their budgets.

Visual aids will help them envision exactly how the various plans will cover their medical expenses. You can simplify the information by breaking it down into images, charts, and videos. The best way to do that is with a user-friendly screen-sharing tool, like CrankWheel.

Your customers won’t have to download anything to use CrankWheel. There’s no setup, and customers will see your slides in real time within seconds.

With the remote control feature, you can give remote control to your customers to create an interactive experience to keep them engaged.

At the appropriate time in your sales appointment, you can have them fill out forms immediately and close the sale on the first appointment.

That said, you’ll want to keep the lines of communication open. You can ensure continued engagement by setting up omnichannel communications.

2. Omnichannel Engagement

Omnichannel engagement refers to customers being able to contact you across multiple platforms.

They should be able to reach you via:

- Phone

- Text

- Chat

- Website

- Social media

Omnichannel systems work best when customers can interact with you on one platform and seamlessly continue the conversation on another channel.

For example, a customer may start texting you and decide they want to speak on the phone. A customer who starts an email conversation may contact you via your website later. A client might start with an online chat and decide to send you an email.

You can prevent customers from finding another agent by being accessible in various ways.

3. Personalization

If you think about it, you probably like to see your names on marketing materials. We’re more receptive to meaningful sales materials and pitches when we feel they’re speaking directly to us.

Every Medicare beneficiary has unique health conditions and preferences. By individualizing marketing materials, your customers will feel valued and understood.

The data you’ve gathered from data-driven insights and your customers will allow you to personalize your presentations. You can tailor your recommendations to their exact needs, improving the customer journey.

For example, some people will be more interested in having lower deductibles even if the premium cost is higher. Others may be more interested in getting coverage that Original Medicare doesn’t cover, such as health, vision, or hearing care, or a gym membership.

More importantly, by helping customers choose the best Medicare Advantage for their circumstances, you are helping them achieve better health outcomes.

Be sure to follow through with personalized follow-ups.

4. Customer Support Excellence

Good customer service is more than answering a customer’s questions. Excellence in customer service requires an empathetic, human response.

Showing empathy doesn’t come naturally to everyone working in a customer service role. That’s unfortunate, considering the pain and anxiety customers experience any time they’re hurt or sick.

To ensure customer support excellence, you might consider setting up an empathy training workshop for yourself and anyone who interacts with customers – call center agents, assistants, and other customer-facing individuals. If you use AI-powered chatbots, test them to ensure the quality of your customer support.

5. Easy Navigation

We’ve all experienced the frustration of searching endlessly for information at some point. The information you need may be somewhere, if only you could find it.

The easier you can make it for a customer to navigate Medicare Advantage enrollment, the easier it will be for them to enroll in one of the plans you recommended.

You can accomplish this by ensuring your websites and portals are easy to navigate for people with all technical skills. Customers may need instructions on how to find providers under their plan, check their coverage, and track claims.

Whatever they’re looking for, you want to make it easy for them to find it.

Enhancing the Customer Journey in Medicare Advantage Sales: Technology’s Role

Approximately 32.8 million people enrolled in Medicare Advantage plans in 2024, according to KFF. While the pool of people needing Medicare Advantage plans is quite large, trust, accuracy, and timing are critical in health plan sales.

The right technology is indispensable in enhancing the customer journey when closing the sale.

Let’s review the critical technology tools every broker and agent needs to ensure excellence in the customer journey.

Customer Relationship Management System (CRM)

Your CRM system allows you to track interactions, preferences, and enrollment statuses at a glance. With integrated data at your fingertips, you can position yourself as a trusted professional offering much-needed advice.

The data you glean can help you create a personalized customer experience at just the right time to move customers to the next state of your sales funnel.

Screen-Sharing Tool

Virtual appointments are the norm in today’s health markets. Customers will retain more when they can visualize the information you’re giving them.

Slides increase engagement. With Crankwheel, you can let the customer drive the interactions by giving them control remotely. Take it back again as needed to keep your presentation moving along.

CrankWheel’s screen-sharing software works just as well for in-person appointments.

Quoting and Enrollment Software

Quoting and enrollment platforms are available to streamline the sales process.

Such platforms allow customers to view plans and prices from different providers, setting the stage for you to offer guidance and make recommendations.

Such tools reduce the administrative burden, decrease errors, and finish the job of enrollment, ultimately enhancing the customer journey.

Compliance Automation Tools

Health insurance is a highly regulated industry. It’s crucial for you to follow CMS regulations to alleviate risks and ensure an ethical sales process.

To that end, compliance automation tools enable you to record calls and automate documentation. These tools streamline the sales process, smoothing the way for the customer and seller.

While technology aids your daily work, it can’t replace the human component of health plan sales. Nonetheless, technology supports you and your clients in the best ways possible.

Drive Medicare Advantage Sales by Creating a Seamless Customer Journey

Overall, you have to view the customer journey as more than a series of touchpoints. Your customers will view their customer journey from the perspective of your expertise and how well their plan serves them over the coming year.

As the Medicare Advantage landscape continues to evolve, you will stand out among other sales professionals and drive better outcomes for those you serve. Ultimately, everyone wins.

Explore how screen-sharing can help you improve your sales results while transforming the customer journey for your clients with a free trial from CrankWheel.